2025 Property Tax Appeals Saved Brazos County Taxpayers $1.8 Billion in Value

O'Connor discusses how 2025 property tax appeals saved Brazos County taxpayers $1.8 billion in value.

BRAZOS , TX, UNITED STATES, October 30, 2025 /EINPresswire.com/ --The home to Bryan, College Station, and the Aggies, Brazos County is seen as an elite area by many in the state. While Bryan College Station may be the core, there is a lot more going on in Brazos County than just the big cities. There are plenty of suburbs, exurbs, and rural communities as well, and there is a growing tech industry to help an already diverse economy grow. Serving people from many surrounding counties as the major hub, Brazos County attracts millions of visitors a year. It is also becoming a place where growing tides of people wish to move to, making it one of the most populated counties in Texas.

This influx of both business and residents has driven Brazos property values to new heights. In fact, between 2014 and 2023, the total taxable value of property in Brazos County doubled. To fight this growing trend, increased businesses and homeowners are turning to property tax appeals. When used with exemptions, these can provide much-needed relief and deliver big savings. Now that both informal and formal appeals to the appraisal review board (ARB) are done, we can judge how effective they were at countering recent increases. His article will explore how taxpayers benefited from protests in many different areas.

Appeals Lowered Home Taxable Values by $743.09 Million

The Brazos Central Appraisal District (BCAD) decreed that residential values increased by 8% in 2025. Not only was this a steep increase, but it was also believed that around 41% of all homes were overvalued to begin with. To bring things down, homeowners used appeals of all types to earn a total decrease of 3.2%. Most of the residential value in the county came from homes between $250,000 and $500,000, which were cut down by 2.1% to $10.35 billion. These had previously seen an increase of 6%. Homes worth under $250,000 totaled $2.59 billion following a reduction of 1.4%. Brazos County has a strong presence of luxury homes, with those worth between $1 million and $1.5 million combining a final sum of $1.88 billion, while those over $1.5 million accounted for $1.49 billion. These saw a decrease of 7.4% and 7.3%. O’Connor was able to save homeowners 8.5% on the total, with a staggering 19.1% cut for homes worth over $1.5 million.

While Brazos County has a reputation for a certain class of affluence, most homes in the area were modest. Over $10.71 billion in residential value came from homes between 2,000 and 3,999 square feet, which was thanks to a reduction of 3.4%. Homes under 2,000 square feet were cut thanks to appeals by 2.1%, falling to a total of $9.39 billion. Homes between 4,000 and 5,999 square feet earned a reduction of 6.5%, reaching $1.71 billion. Luxury residences between 6,000 and 7,999 square feet saved a whopping 7.4%, dropping to a total of $350.46 million.

Residential construction patterns in Brazos County show a strong lean toward recency. Over 46.7% of all value was built between 2001 and 2020, which translates to $10.46 billion after a reduction of 3.7%. While getting a cut of 2.3%, homes built from 1981 to 2000 fell to a total of $4.80 billion. New construction surged in value by 31.3%, reaching a total of $2.93 billion. This was quickly contested by appeals, lowering the value by 4.7% to $2.78 billion. Bucking the trend, homes built before 1960 jumped 9.8% in value to $1.72 billion. This was brought down 2.2% by protests to $1.69 billion.

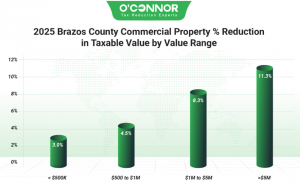

Commercial Taxable Value Slashed by 9.7%

Business owners across Brazos County got serious sticker shock when BCAD assessed massive increases to commercial properties of all types in 2025. The total taxable value for business real estate spiked a shocking 29%, reaching a new final sum of $10.85 billion. As businesses typically protest every year as a cost-cutting measure, various appeals were deployed. A solid 9.7% was brought back, reducing the total to $9.79 billion. Business real estate worth over $5 million had the most value and the highest cut at $6.33 billion and 11.3% respectively. Those between $1 million and $5 million were reduced 8.3% to $2.15 billion. These two business types saw spikes of 30% and 28% respectively. O’Connor was able to help business clients cut14.9% in total, with a reduction of 17.4% for businesses worth over $5 million.

In typical Texas fashion, the No. 1 property according to value was apartments at $5.07 billion, though this was lowered 11.2% to $4.50 billion. Offices were originally second place in total value, but a reduction of 9% dropped them to third place at $1.45 billion. Raw land took over the No. 2 slot with $1.52 billion, which was thanks to a cut of 2.6%. Retail got the largest reduction by percentage with 15.6%, which translated into a final total of $869.54 billion. Warehouses had seen the largest increase with 45.8%, but this was soon slowed by a reduction of 9.3%, resulting in a final sum of $967.63 million.

Commercial property largely followed the same pattern for age of construction as homes did. Just under half of all business value was built between 2001 and 2020, which totaled $4.82 billion after a decrease of 8.6%. In second place was commercial property constructed between 1981 and 2000, which reached $1.82 billion after a reduction of 13.4%. New construction saw another spike, this time a giant surge of 76.5%. This was somewhat countered by a reduction of 8.7%, bringing the new total to $647.23 million. Properties built before 1960 saw an increase of 55%, while those from 1961 to 1980 jumped 43.6%. These were later appealed down to 16.3% and 19.3% respectively.

Apartments Counter 30% Increase with 11% Reduction

Apartments have been the top commercial property type for some time, which made their value increase of 30% in 2025 have an outsized impact on the grand total. While initially rocketing to $5.07billion, this was slowed by an impressive decrease of 11.2%, which led to a final tally of $4.50 billion. $2.86 billion of the total value came from apartments built between 2001 and 2020, following a reduction of 7.8%. A large reduction of 17.1% dropped the value of apartments built from 1981 to 2000 to $715.25 billion. The pattern of huge gains for new construction continued, with a staggering increase of 84.2%. Focused appeals managed to cut this by 7.9%, leading to a total of $429.52 million. The total for O’Connor clients was reduced by 21.7%.

Offices Saved 9% Thanks to Protests

Offices went from being in second place to third place thanks to appeals, the only category to switch places with another. In this case, offices saw their value cut below that of raw land. Offices reached a total of $1.45 billion following an overall reduction of 9%. These properties had previously seen a huge increase of 26.2%, so this drop was welcomed. Like other properties, the biggest value source was buildings constructed between 2001 and 2020, with $766.91 million coming from this timeframe after a reduction of 6.7%. Offices built from 1981 to 2000 saw the largest cut by percentage, dropping 10.5% to $474.65 million. The largest increase in office value was not new construction, but rather offices built between 1961 and 1980, which soared 56.7% compared to new construction’s 56.2%. These two very different timeframes were cut by 17.6% and 2.7% respectively. Office owners that used O’Connor saw a total reduction of 13.2%.

BCAD only divided offices into two categories. The largest by far were generic apartments, which totaled $1.01 billion after a reduction of 10.3%. Medical offices decreased by 5.6% to $436.49 million.

Retail Reductions Slow Historic Value Spike

Retail experienced an enormous spike of 39.9% in 2025, with the total rocketing to $1.03 billion. Appeals were quickly launched, cutting the total by 15.6% to $869.54 million. Keeping with tradition, retail spaces built from 2001 to 2020 had the lead in value with $419.44 million after a reduction of 16.6%. Cutting 13.6% from their total value, stores built between 1981 and 2000 reached $260.25 million. Retail spaces built before 1961 saw a huge increase of 57.2%, but this was countered by 18% thanks to appeals. New construction thundered up the charts with an increase of 66.8%, and this was offset by a decrease of 17%. These two categories ended up with totals of $17.02 million and $44.60 million respectively. Retail owners that joined O’Connor saw an overall cut of 17.8%.

BCAD split retail stores into three subtypes. Community shopping centers got a substantial decrease of 14.4% but were still No. 1 with $427.72 million. Neighborhood shopping centers came in at No. 2 with $373.67 million, falling thanks to a cut of 17.6%. Single-occupancy stores had a post-appeal total of $68.14 thanks to a decrease of 11.7%.

Warehouses Cut $99.16 Million from Enormous Value Spike

Warehouses got hit with the largest increase of any commercial property with a jump of 48.5%, translating into a new total of $1.07 billion. While not the biggest cut, the appellant reduction of 9.3% was still impressive, leading to a final sum of $967.62 million. The boom period of 2001 to 2020 produced the most value again, this time $427.76 million after a reduction of 8.7%. Those built from 1981 to 2000 originally saw a jump in value of 53.2%, but this was protested down by 8.5% for a final tally of $275.09 million. Following a spike of 57.1%, warehouses constructed between 1961 and 1980 fell 11.4% to $85.58 million. New construction, as usual, leaped up 59.4%, but this was met with an appeal decrease of 10.6%, resulting in a total of $162.36 million. Warehouse owners that joined O’Connor improved on all of these numbers and nabbed a total reduction of 10.5%.

BCAD used only three subtypes to categorize all warehouses. After being cut by 8.6%, office warehouses totaled $751.53 million. Mini warehouses reached $215.67 million after a reduction of 11.7%. Generic warehouses did not see a reduction or a gain and had a final total of $422.79 million.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.