Retail Banking Market In 2029

The Business Research Company’s Retail Banking Global Market Report 2026 – Market Size, Trends, And Forecast 2026-2035

LONDON, GREATER LONDON, UNITED KINGDOM, January 7, 2026 /EINPresswire.com/ -- "Retail Banking Market to Surpass $4,820 billion in 2029. Within the broader Financial Services which is expected to be $47,552 billion by 2029, the Retail Banking market is estimated to account for nearly 10% of the total market value.

Which Will Be the Biggest Region in the Retail Banking Market in 2029

North America will be the largest region in the retail banking market in 2029, valued at $1,488 billion. The market is expected to grow from $1,001 billion in 2024 at a compound annual growth rate (CAGR) of 8%. The strong growth in the forecast period can be attributed to the rise in the use of smartphones, expansion of e-commerce and increasing consumer spending.

Which Will Be The Largest Country In The Retail Banking Market In 2029?

The USA will be the largest country in the retail banking market in 2029, valued at $1,358 billion. The market is expected to grow from $920 billion in 2024 at a compound annual growth rate (CAGR) of 8%. The strong growth in the forecast period can be attributed to the expansion of e-commerce, rise in the increasing internet penetration and surge in the increasing internet penetration.

Request a free sample of the Retail Banking Market report

https://www.thebusinessresearchcompany.com/sample_request?id=18714&type=smp

What will be Largest Segment in the Retail Banking Market in 2029?

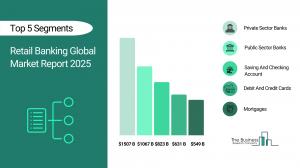

The retail banking market by type into public sector banks, private sector banks, foreign banks, community development banks, and non-banking financial companies (NBFCs). The private sector banks market will be the largest segment of retail banking market segmented by type, accounting for 47% or $2,259,685 million of the totals in 2029. The private sector banks market is supported by advanced digital banking solutions, customer-centric service models, competitive interest rates and financial products, rapid adoption of fintech innovations, expansion of branch and automated teller machine (ATM) networks, growing demand for personalized banking experiences, increasing disposable income and urbanization, strong focus on asset quality and risk management, strategic partnerships with e-commerce and digital payment platforms and rising investments in cybersecurity and fraud prevention.

The retail banking market are segmented by service into saving and checking account, transactional account, personal loan, home loan, mortgages, debit and credit cards, automated teller machine (ATM) cards, and certificates of deposits. The debit and credit cards market will be the largest segment of the retail banking market segmented by service, accounting for 19% or $920,613 million of the totals in 2029. The debit and credit cards market is supported by increasing consumer preference for cashless transactions, rising adoption of contactless and mobile payment technologies, growing e-commerce and digital shopping trends, expanding rewards and cashback programs and financial inclusion initiatives promoting card-based banking solutions.

What is the expected CAGR for the Retail Banking Market leading up to 2029?

The expected CAGR for the retail banking market leading up to 2029 is 7%.

What Will Be The Growth Driving Factors In The Retail Banking Market In The Forecast Period?

The rapid growth of the global retail banking market leading up to 2029 will be driven by the following key factors that are expected to reshape customer engagement, risk management, and day-to-day financial services delivery worldwide

Increasing Internet Penetration-The increasing internet penetration will become a key driver of growth in the retail banking market by 2029. The widespread availability of the internet has enabled greater adoption of online and mobile banking, reducing the need for physical branch visits. This shift enhances customer engagement and broadens the reach of retail banks. Increased internet usage also drives growth in digital payments, e-commerce, and online transactions, further integrating banking services into everyday financial activities. To capitalize on this trend, retail banks collaborate with fintech companies to offer seamless digital payment and lending solutions. As a result, increasing internet penetration is anticipated to contributing to a 2.0% annual growth in the market.

Expansion Of E-Commerce- The expansion of e-commerce will become a key driver of growth in the retail banking market by 2029. E-commerce drives a surge in online transactions, increasing the demand for banking services such as digital wallets, mobile banking, and card payments. This shift enhances banks’ revenue through transaction fees and deeper customer engagement with digital financial products. As businesses expand their online presence, they require merchant accounts, payment gateways and point of sale solutions, creating additional revenue streams for banks that facilitate these services. As a result, expansion of e-commerce is anticipated to contributing to a 1.5% annual growth in the market.

Increasing Digitalization- The increasing digitalization will serve as a key growth catalyst retail banking market by 2029. The rise of e-wallets, UPI and contactless payments has significantly increased digital transactions, driving banks' revenue through transaction fees and digital services. This shift toward a cashless economy expands banking adoption, enabling financial institutions to offer a broader range of digital products, including robo-advisors, microloans, and insurance. Mobile and online banking platforms enhance customer convenience, fostering greater engagement and satisfaction. Therefore, this increasing digitalization is projected to supporting to a 1.0% annual growth in the market.

Increasing Consumer Spending- The increasing consumer spending will serve as a key growth catalyst for retail banking market by 2029. As consumer income and expenditures rise, the demand for banking products such as credit cards, loans and digital payment solutions expands. Higher earnings also contribute to increased savings and deposits, enhancing banks' lending capacity. This surge in consumer spending drives growth in personal loans, auto financing, and mortgages, which serve as significant revenue streams for retail banks. Therefore, this increasing consumer spending will be projected to supporting to a 0.7% annual growth in the market.

Access the detailed Retail Banking Market report here:

https://www.thebusinessresearchcompany.com/report/retail-banking-global-market-report

What Are The Key Growth Opportunities In Retail Banking Market in 2029?

The most significant growth opportunities are anticipated in the private retail banking market, the debit and credit card payments retail banking market. Collectively, these segments are projected to contribute over $1,258 billion in market value by 2029, driven by rapid digitalisation, expanding consumer adoption of mobile and online banking, and the accelerating shift toward cashless payment ecosystems. This surge is further supported by innovations in card-based payments, embedded finance models, and improved credit/debit card penetration across emerging economies. Together, these forces are reshaping customer expectations for convenience, security, and real-time financial services delivery fueling transformative growth within the broader Retail Banking & Payment Cards industry.

The private retail banking market are projected to grow by $907,296 million, the debit and credit card payments retail banking market by $350,307 million over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.